Betting money on climate solutions, Bitcoin and the environment, Beth Harmon plays climate change

Climate Pioneers Issue No7

Receive stories and surprises about climate solutions directly in your inbox.

We cannot not invest. Every day we must make decisions on spending time and money. In this issue we look at how consumers and companies invest capital in climate solutions, startups and stocks.

A fresh flood of capital to cool down global warming

Knowledge snack: Bitcoin – pros and cons through a climate lens

How they do it: The fast route to carbon neutrality

Best pick: Play climate change like Elizabeth Harmon

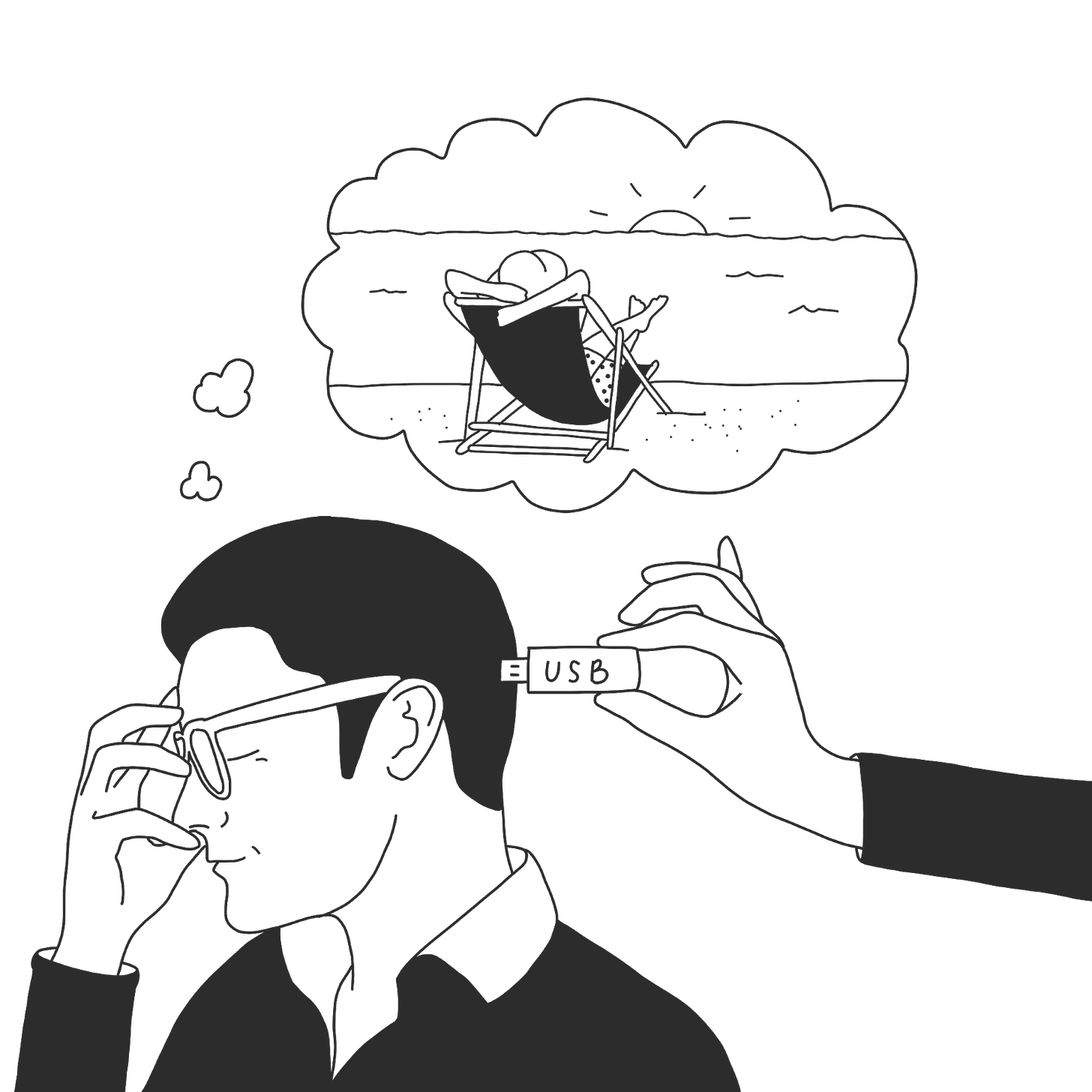

Future fantasy: Download your holiday adventures

This issue is free. You ‘only’ have to invest your valuable attention when scrolling and reading through it. You can place your advertisement here. Check out the new offer.

Climate investing: A fresh flood of capital to cool down global warming

The “Greta Effect” is real. Students strike school on Fridays and investors allocate capital to reverse climate change. The main story in bullet points:

In 2019, corporate and venture capital funds invested $16 billion in solutions that will reduce and remove carbon emissions.

However small or big our financial vote is, climate investing represents an opportunity to make a difference and express a voice.

Everyone can make bets on climate solutions via publicly traded stocks, crowdfunded projects, banking and savings accounts.

As all aspects of the economy need to decarbonize, the investment focus shifts (from cleantech) to climate tech.

The noise around sustainability adds a layer to the numbers game that requires investors to remain vigilant and open minded at the same time.

I grew up in a world where capitalism was set apart from environmentalism. This has changed. So-called impact investors started to allocate capital to solve social and environmental issues. The trend is particularly expanding into technologies addressing the risks of climate change:

A growing number of venture capital firms are spotting climate as an investment opportunity.

According to the Diamond List, a list of 75 early stage climate startups, investments in climate ventures increased fortyfold in the last 6 years.

In 2019, corporate and venture funds have deployed $16.1 billion into climate solutions.

Whilst most of these funds are closed to the public, everyone with internet access can directly search climate-related startup deals on Republic and Seedrs, support individual climate efforts on Kiva and Lendahand or invest into projects on Bettervest and Ecoligo. In the coming years, financial technology and decentralized finance are likely to make the investment sector more accessible.

For publicly traded stocks, banks offer baskets that adhere to environmental standards. “We know that climate risk is investment risk” wrote Larry Fink, the CEO of Blackrock, an investment company that manages over $8 trillion, earlier this year. Not just investing, also how you pay or where you keep your money matters. Banks like Tomorrow, Atmos or Triodos are actively positioning themselves to ‘use’ your savings for ‘good’ causes. And for your purchases, credit cards that plant trees or offset emissions have been launched. Services like Carbon Collective or Yova let you invest according to sustainable values. If you care about a specific field, you can go through an ESG portfolio like IEM, EIP or ETHO and pick a stock from their holdings. For example:

WOA may be your choice in regenerative agriculture,

BYND for plant-based food or

TSLA for renewable energy.

In the energy sector there is also a rising number of special-purpose acquisition companies. Their special purpose is to take thriving companies to the stock market. For example, ArcLight Clean Transition Corp. has merged with the electric mobility company Proterra and trades as ACTC.

But how to form an educated opinion about an investment option? Using a company’s product helps. Simply put, if you love Converse shoes, you can buy Nike stocks. Such a direct evaluation approach may be difficult with climate investment opportunities, unless you are a customer or industry-insider. From the outside it can help to evaluate the option and get a better feeling about its potential by:

Researching the internet, going through videos, podcasts, threads and customer reviews. Reading financial statements and reaching out to people working for the company in mind. Checking the target’s websites and apps in detail, because companies who walk on a solid digital foundations might have an advantage.

Reading and imagining future scenarios and thinking how your choices will play out in the long-term is another important exercise for making investment decisions. This also includes wondering what could potentially go wrong. It can help to write all this down as an investment thesis or decision-making journal (see this example).

As impact investing is trending, it is super important to cut through the noise and find no-hype information sources on sustainability. In a world where religion is fading, marketers like me add a pinch of spirit to every product and service to satisfy the human need for spirituality. If investing is becoming a religion that holds you accountable for your actions, then funds are modern churches that channel your beliefs. Dogmatic beliefs may not be congruent with scientific knowledge and climate investors must remain open to new solutions, ideas and people entering the market. For example, the transition from cleantech to climate tech might require an ideological shift from against- to pro-nuclear energy. But also, folks moving from software into climate tech, might need to adapt expectations in regards to scaling and returns. In that sense, sound judgement is an achievement and investing is an act of responsibility and participation in our society’s destiny.

The climate problem has reached broad consensus and large parts of the economy will be undergoing decarbonization. Investors, governments and companies committed to net-zero emissions weigh almost hundred trillion dollars by now. In the end, all the capital will be worthless if it didn’t help to cool down global warming.

Disclaimer: This is not financial advice. I do not participate in any of the above listed investment options, nor did I receive any fees or other benefits for listing them.

Knowledge snack: Bitcoin – boosting renewable energy production or polluting the environment?

The cryptocurrency that glues the internet community to the screens has an energy problem. To mine and transact bitcoin, data centers consume the same amount of electricity as the entire country of Chile. The source of the electricity is estimated to be 20-70% renewable, which translates into CO2 emissions ranging from 22 to 58 million tons per year. That’s undoubtedly a lot. But are there any upsides for the climate? It’s disputed whether Bitcoin can or cannot incentivize renewable energy production by converting clean excess power into monetary value. Bitcoin Strategist Meltem Demirors claims that “Bitcoin is a money battery that allows energy to be utilized over long spans of space and time”. However, Hal Finney(RIP), the bitcoin developer involved in the first transaction was aware of the problem in 2009.

Initiatives and ideas to solve the challenge are underway and hodlers can calculate the footprint of their bitcoin. In the meantime it is fair to ask whether the traditional financial system including operating banks, printing bills, minting coins and mining gold has a better environmental impact than bitcoin.

The “How they do it” section explores how businesses are tackling climate change

How they do it: Delivery Hero takes the fast route to carbon neutrality

The food delivery company Delivery Hero runs carbon neutral in Europe and Latin America. According to an article in Sifted, the company has offset 215’000 tons of CO2 to equalize their estimated emissions. Its chief director of sustainability Jeffrey Oatham admits that “Offsetting has a troubled past” and justifies their chosen path as follows:

“It’s a very short time frame to begin with, and the only way to achieve [carbon neutrality] at that pace is through offsetting”

“We want the emissions to be addressed in some way while we take time to find solutions to reduce… We can’t really do the big, strategic, scaled reduction programmes until we know where the big problems are.”

“All players need to do something. We have to step up, and in doing so we hope to show that it’s possible. Whether or not it’s possible by reducing first, we’ll leave that to others, but we want to show that having an offsetting-led [strategy], so we can account for all of our emissions and then find sustainable ways to reduce those over time, is also possible.”

It’s great the company has set out on this journey, in the long run they should aim towards aligning carbon offsetting with net-zero.

Would you like to feature the efforts of your organisation? Please answer four questions.

The “Best pick” section present a selected article, podcast, video or other resource

Best pick: Play climate change like Elizabeth Harmon

In a recent article, Project Drawdown Executive Director Jonathan Foley compares the climate fight to a chess game and outlines seven rules to win it.

The board is bigger than we think, and includes more than fossil fuels.

We need to rapidly reduce all sources of greenhouse gases, not just a few.

We need to protect and maintain nature’s massive “sinks” of greenhouse gases.

We should create new, long-term carbon sinks. But we need to be keenly aware of their limitations.

We need to actively manage a broad portfolio of solutions. And we need to consider solutions that come from outside traditional climate thinking.

We need to pursue multiple tactics to bring solutions to scale.

See the whole board, and collaborate with others to play the game.

The “Future fantasy” section provides a fictional short story from the future

Future fantasy: Download your holidays on the marketplace of memories

26.2.2038 – Travelling is a carbon-intensive activity. The hunger to explore new places accounts for 10% of global greenhouse gas emissions. The push and incentives for more local tourism has not made any significant difference in the last years. The negative trends inspired neuroscientist Zhang Qian to rethink the underlying assumption of travelling: “The best holidays are made of experiences and connections we have formed with others and ourselves. We safeguard these positive memories deeply in our brains to access anytime”. Zhang thinks of developing an alternative travelling solution. “What if you could plan your most fantastic holidays with your best friends and then experience it without having to physically relocate?” or “What if you could live and store the real memory of climbing Mount Everest without leaving your home?” or “What if you could be your favourite basketball player just for one game?”. Zhang’s brain–computer interface startup Memory has raised 10 bitcoins from over 800 people who can’t wait to test the experience firsthand. With the capital, Memory’s developer community will launch an experience designer platform and contract 20 extreme experience creators like athletes and adventurers. Eventually the idea is to democratize experiences and exchange to and from everyone on the marketplace of memories.

In the next issue

A main story, a Knowledge snack, How they do it, a Best pick and another Future fantasy will wait for you. Subscribe now, if you want to receive the next issue. Together we can help reverse climate change.

Services

This month I launched the services page. I support companies in marketing, branding and business questions. If you would like to discuss an opportunity, please write an email or choose a slot whenever you are available. I look forward to finding out how I may assist you.

About

My Name is Sam. All I wanted as a teenager is to get away from the farm I grew up. So I worked, studied and travelled to over 40 countries. Only to come back and run a startup for meat from organic family farms. In 2019 I started Project Oasis with the idea to restore land and remove CO2. The insights from talking to farmers and sustainability professionals emerged into an online magazine about climate solutions. Climate Pioneers is a monthly magazine. Readers receive fresh findings at the intersection of business, science and sustainability. By the way, the footprint of this publication is removed via soil carbon certificate.